Why Doesn't My 1099 Amount Match My Cash Flow Report?

If your 1099-MISC and Cash Flow Report show different amounts, it's almost always due to prepaid rent. This is one of the most common questions we receive—and the most misunderstood. This guide covers everything you need to know.

Audience: Property owners who have prepaid rent on their tax documents and want to fully understand how it's reported, why amounts differ between documents, and how to handle it at tax time.

What Is Prepaid Rent?

Prepaid rent occurs when your tenant pays rent before it's due. The most common example is a tenant paying January rent in late December. But it also includes large prepayments—if your tenant paid several months (or even a full year) in advance, that entire amount is considered prepaid rent.

How the IRS Treats Prepaid Rent

The IRS requires prepaid rent to be reported as taxable income in the year it was received—not when it applies to the lease. This is called cash-basis reporting.

If your tenant paid $1,500 on December 28, 2025 for January 2026 rent, that $1,500 is taxable income for 2025 and will appear on your 2025 1099-MISC. The same applies to large prepayments—if your tenant prepaid $12,000 in 2025 to cover rent through mid-2026, the full $12,000 is reported on your 2025 1099.

How Prepaid Rent Shows Up on Your Documents

Your 1099-MISC reports income in the year funds were received. If your tenant prepaid, those funds are included on this year's 1099 even if they apply to next year's rent.

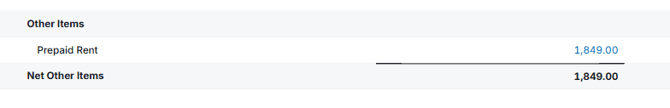

Your Cash Flow Report includes prepaid rent in the Other Items section at the bottom—not in the income section at the top. This is the net prepaid rent amount that accounts for the difference between your Cash Flow income and your 1099.

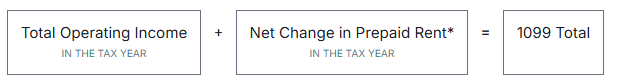

The formula: Cash Flow Income + Net Prepaid Rent = 1099 Amount

Your Owner Statement only shows funds that have been applied to charges. Prepaid rent won't appear on your statement until it's applied to a future month. In the meantime, these funds are held in a special account within our trust where they remain safe and untouched.

Understanding Net Prepaid Rent

Your 1099 reflects the net change in prepaid rent for the year, not just new prepayments. Here's what that means:

Positive adjustment: Your tenant prepaid rent this year that applies to next year. This amount is added to your 1099.

Negative adjustment: You had prepaid rent last year that applied to this year. Since it was already reported on last year's 1099, it's subtracted from this year's total to avoid double-counting.

Zero or near-zero: If you've had prepaid rent multiple years in a row, the amounts may net out—last year's prepayment comes off, this year's prepayment goes on, and the difference nets out to 0.

Example:

- December 2024: Tenant prepays $1,500 for January 2025 → added to 2024 1099

- December 2025: Tenant prepays $1,500 for January 2026 → added to 2025 1099

- Your 2025 1099 shows: -$1,500 (last year's) + $1,500 (this year's) = $0 net prepaid rent

There are many possibilities depending on your tenant's payment history, the system tracks, and includes the net change on your Cash Flow Statement and the amount is either added or subtracted from your 1099 amount accordingly.

Why MoveZen Can't Change This

MoveZen cannot delay reporting received funds, reclassify prepaid rent for tax timing, or alter IRS-mandated reporting. These rules are set by the IRS, not by us. Changing how we report would create compliance risk for both you and MoveZen.

What You Need to Do

Share both your 1099 and Cash Flow Report with your CPA. Your tax professional is likely familiar with prepaid rent and may adjust income timing, apply offsets or accruals, or account for prepaid income in other ways. This is very common in rental property accounting. We're simply reporting the income as required by the IRS.

Watch: Prepaid Rent Explained

Frequently Asked Questions

Why does my 1099 include rent for a future month? The IRS requires income to be reported when received, not when rent is earned. If your tenant paid early, it's included on this year's 1099.

Does this mean I'm being taxed twice? No. The net prepaid rent calculation ensures you're only taxed once. If prepaid rent was reported last year, it's subtracted from this year's total.

Why don't I see prepaid rent on my Owner Statement? Owner Statements only show funds applied to charges. Prepaid rent is held in our trust account until it's applied to a future month's rent.

Can I ask MoveZen to report it differently? No. 1099 reporting rules are set by the IRS and we must follow them.

What if my tenant made a large prepayment covering multiple months? The entire amount is reported on the 1099 in the year it was received, even if it covers rent well into the future.

Why is there a negative number for prepaid rent on my 1099? You likely had prepaid rent last year that applied to this year. Since it was already taxed last year, it's subtracted from this year's income.

What if I have prepaid rent every year? The amounts net out each year. You'll see last year's prepayment subtracted and this year's prepayment added. The net impact may be small or even zero.

Resources

- IRS Topic 414: Rental Income and Expenses

- Complete Guide to Owner Tax Documents

- Where to Find Your Tax Documents in the Portal

- What Records Should I Keep for Tax Purposes?

- Prepaid Rent Information Guide